FCA Authorisation Support: Expert Guidance.

FCA Authorisation Support: Expert Guidance.

Errors in the FCA authorisation process can jeopardize your financial aspirations and lead to serious regulatory implications. Whether you’re an aspiring firm or an established company seeking compliance, understanding these pitfalls is crucial for a successful application. In this listicle, you will uncover the ten most common mistakes made during the FCA authorisation process. By learning from these errors, you can position your business for success and avoid the setbacks that many others have faced.

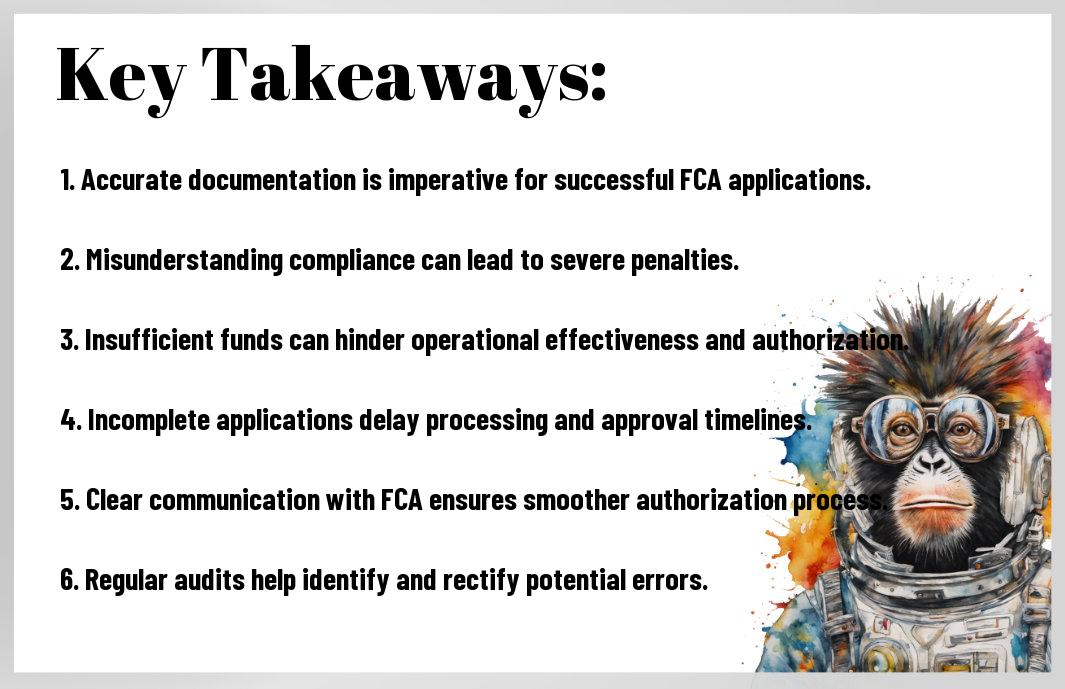

Key Takeaways:

- Understanding the common errors in FCA authorisation applications can significantly increase the likelihood of approval.

- Effective communication and thorough documentation are crucial in addressing compliance requirements and avoiding setbacks.

- Regular training and updates on regulatory changes can help firms stay compliant and mitigate potential issues in the authorisation process.

Incomplete Application Forms

Your application for FCA authorisation may face delays or outright rejection if it is incomplete. Ensure that all sections are filled in accurately and thoroughly, as even minor omissions can raise red flags during the review process. Taking the time to review your application before submission can save you hassle down the line.

Missing Documents

Assuming that your application will be accepted without all the required documents can lead to significant setbacks. The FCA requires specific documentation supporting your application, so you should collect and submit these materials in a timely manner. Failing to include necessary documents may result in your application being delayed or denied.

Incorrect Information

Missing accurate details can compromise your application’s integrity. If the information you provide is misleading or inconsistent, it could be perceived as an attempt to conceal critical issues. This not only extends the review timeline but might also jeopardize your chances of obtaining authorisation entirely.

For instance, inaccuracies regarding your financial standing or ownership structure could trigger further scrutiny and lead to compliance issues. The FCA conducts thorough due diligence, and any discrepancies will not go unnoticed. It is imperative to ensure that all details, such as your business model, financial projections, and key personnel qualifications, are presented truthfully and transparently to facilitate a smoother approval process.

Failure to meet criteria

The FCA has stringent criteria that businesses must meet for authorisation, and failure to adhere to these requirements can lead to application rejection. These criteria encompass financial stability and operational capability, ensuring that only reputable entities operate within the financial sector.

Financial thresholds

For your application to be successful, you must meet specific financial thresholds set by the FCA. These thresholds are designed to ensure that you have the necessary resources to operate effectively and mitigate risks, thereby safeguarding consumers and the integrity of the financial markets.

Experience requirements

Some sectors demand that you demonstrate adequate experience and expertise in your chosen field. This includes having qualified personnel and relevant industry knowledge to manage your operations responsibly and effectively.

You can enhance your chances of meeting the FCA’s experience requirements by showcasing your team’s qualifications and industry experience in your application. Detail any relevant qualifications, work history, and skills your team possesses that directly relate to the financial services you aim to provide. Additionally, having a solid business plan highlighting your strategic approach to operations increases your credibility, reaffirming that you are well-equipped to handle the responsibilities of a regulated firm.

Poor Compliance History

Now that you understand the importance of FCA authorisation, it’s vital to consider how a poor compliance history can impact your application. Your past dealings and adherence to regulations will be scrutinised, and any lapses may raise red flags for the FCA, leading to potential delays or rejection of your authorisation.

Past Violations

While examining your compliance history, the FCA will focus on any past violations you may have incurred. These could include regulatory non-compliance, financial misconduct, or general disregard for established standards. Such incidents can profoundly affect your credibility and your eligibility for authorisation.

Unresolved Issues

The FCA takes a firm stance on unresolved issues from previous compliance matters. If you have outstanding investigations, complaints, or disputes, these could hinder your chances of gaining authorisation. It’s advisable to resolve any concerns before submitting your application, as the FCA will be less inclined to overlook existing problems.

Issues related to unresolved compliance matters can present a significant barrier in your pursuit of FCA authorisation. The FCA expects transparency regarding all past and present violations, and if any unresolved concerns remain, they will likely hinder your progress. To enhance your chances, you should proactively address these issues, ensuring that they are fully resolved and documented, as this demonstrates your commitment to maintaining regulatory standards.

Inadequate Business Plans

After submitting your FCA application, inadequate business plans can lead to significant hurdles in obtaining authorisation. A well-structured business plan demonstrates your understanding of the market, compliance requirements, and operational strategy. If your plan lacks substance, it raises red flags for the FCA, making it harder for you to gain approval for your financial services firm.

Lack of Detail

Little detail in your business plan can make it difficult for the FCA to assess your viability. Vague descriptions and ambiguous goals can hinder the approval process, as regulators need clear and specific information regarding your business strategy, target market, and compliance measures. Ensure that every section of your plan is thoroughly articulated, leaving no room for interpretation.

Unrealistic Projections

Lack of realistic financial projections in your business plan can detrimentally affect your application. The FCA requires evidence that your forecasts are grounded in reality to maintain market integrity. You need to support your financial assumptions with credible data and a clear rationale, as any glaring discrepancies may lead to distrust by regulators, ultimately jeopardising your chances of authorisation.

Any projections that appear overly optimistic or not backed by market analysis can be a red flag for the FCA. Understand that your financial forecasts should reflect achievable growth, take into account market conditions, and include potential risks. Providing a clear growth strategy along with realistic financial expectations will not only strengthen your application but also enhance your credibility in the eyes of the regulators.

Misrepresentation of Funds

Keep in mind that misrepresentation of funds can lead to severe consequences for your FCA authorisation process. Providing false or misleading information about the financial resources available to your business raises red flags during scrutiny, and fails to inspire confidence in your operations. Ensuring transparency is not just a regulatory requirement; it’s also necessary for your credibility in the market.

Source Verification

One of the key elements in the FCA authorisation process is source verification. You must provide clear documentation that demonstrates where your funds originated. Failure to do so can result in questions regarding the legitimacy of your financial situation. Clear and concise records will strengthen your application and reassure the FCA of your business’s integrity.

Unexplained Discrepancies

Little inconsistencies in your financial statements can become significant issues during the authorisation review. Discrepancies can signal underlying problems, which could lead to regulatory concerns or even rejection of your application. Diligently reviewing your financial records to eliminate any errors is necessary for a successful FCA authorisation process.

Discrepancies in your financial statements can lead to intense scrutiny from the FCA. Even minor inconsistencies can paint a negative picture of your financial stability or integrity. It’s important to conduct thorough reviews and reconciliations of your financial records before submission. This not only allows you to correct potential errors but also assures the FCA that your operations are legitimate and well-managed. Being proactive in identifying and resolving discrepancies can significantly enhance your chances of securing the necessary authorisation.

Inconsistent Communication

Despite the importance of clear communication during the FCA authorisation process, many applicants encounter inconsistent messages from the regulator. This can lead to confusion and frustration, as conflicting guidance may hinder your ability to meet the necessary requirements for authorisation. Addressing these inconsistencies is vital to ensure a smoother path to compliance and a successful application.

Delayed Responses

If you find yourself waiting extended periods for replies from the FCA, it could significantly stall your authorisation application. Delays can lead to uncertainties in your planning and operations, affecting your business timeline and potentially impacting your financial forecasts. Expedite your process by following up appropriately on any pending inquiries.

Lack of Transparency

The FCA’s lack of transparency can undermine your confidence in the authorisation process. Insufficient information about the requirements, decisions, or timelines can leave you in the dark, making it challenging to navigate the application successfully. You deserve to have clarity and insight into your application’s progress and the rationale behind any decisions made.

Communication is key to establishing a clear understanding of the FCA authorisation process. When the regulator fails to provide transparent information, you may feel disoriented and uncertain about the steps you need to take. Strive to obtain as much information as possible, and consider asking direct questions to mitigate any confusion. Ensuring that you have the right information can empower you to make informed decisions and move forward with confidence.

Failure to Disclose Risks

To act transparently, it is vital that firms disclose all potential risks in their offerings. Failure to do so can lead to serious repercussions with the FCA, eroding client trust and exposing your business to significant liabilities. As a regulated entity, you are obligated to ensure clients have a comprehensive understanding of the risks involved, creating a basis for informed decision-making that protects both your firm and your clients.

Operational Challenges

There’s a spectrum of operational challenges that can arise from not fully disclosing risks. Managing compliance, training staff, and ensuring consistent communication with clients can become daunting tasks if the potential threats are not clearly articulated. It’s crucial that your operational framework incorporates risk disclosure to streamline processes and build a culture of transparency within your organization.

Market Volatility

You may find that market volatility significantly impacts your clients’ investments and your firm’s obligations. Clients expect that you will provide insight into how these fluctuations can affect their portfolios, especially in periods of economic uncertainty. Without effective communication around these risks, you could face dissatisfaction among clients or regulatory scrutiny.

You can enhance your disclosure practices by offering tailored insights regarding market conditions. Regularly updating clients about current market trends, potential risks, and your strategies to mitigate them empowers them to navigate fluctuating environments with greater confidence. This proactive approach not only fosters trust but protects your firm’s reputation in volatile markets.

Oversight in Governance

Not maintaining proper oversight in governance can lead to significant lapses that jeopardize your FCA authorization. Effective governance structures ensure that your firm adheres to regulatory standards and mitigates risks. Without careful supervision, you may find yourself exposed to compliance failures, which could ultimately result in severe repercussions for your organization.

Weak Internal Controls

You’ll discover that weak internal controls can invite governance problems that affect your firm’s integrity and sustainability. These controls are necessary for ensuring compliance, safeguarding your assets, and promoting operational efficiency. If your internal controls are insufficient, you risk overlooking vulnerabilities that may lead to regulatory infractions and financial losses.

Ineffective Leadership

Now, ineffective leadership can significantly impair your organization’s ability to navigate the complexities of FCA regulations. Leaders play a vital role in establishing a culture of compliance and accountability. When leadership fails to communicate effectively or lacks a clear vision, it can create an environment where compliance takes a back seat to other priorities.

Internal dynamics often suffer as a result of ineffective leadership. Poorly communicated expectations can lead to confusion among staff, inhibiting their ability to act in accordance with regulatory requirements. When your leaders lack the necessary skills to promote a strong compliance culture, employees may become disengaged, fostering an atmosphere of negligence. This not only puts your FCA authorization at risk but can also damage your firm’s reputation. It’s necessary to cultivate strong leadership that prioritizes both compliance and operational excellence.

Neglecting Consumer Protection

Once again, neglecting consumer protection can lead to severe repercussions for your FCA authorization. You have a responsibility to uphold the standards of care required in financial services, ensuring that your customers are treated fairly and their interests prioritized. Ignoring this duty can result in not only regulatory penalties but also damage to your reputation and consumer trust.

Compliance with Regulations

You’ll need to stay informed about regulatory changes and ensure your practices align with the latest guidelines set by the FCA. Non-compliance can result in significant fines or even loss of your authorization, so it’s imperative to establish systems that allow you to monitor and adapt to regulatory requirements efficiently.

Fair Treatment Obligations

Some firms overlook their fair treatment obligations, leading to practices that can harm consumers and violate FCA rules. You must ensure that your services and products are designed with fairness in mind, treating every client equally and transparently.

To maintain compliance with fair treatment obligations, you should develop clear policies that prioritize consumer welfare. This includes providing accurate information about products, avoiding misleading advertisements, and offering suitable recommendations based on clients’ needs and circumstances. Regular training for your staff on these principles can also enhance your commitment to treating customers fairly, fostering a positive ethos within your organization.

Summing up

With these considerations in mind, it’s clear that navigating the FCA authorisation process requires diligence and attention to detail. By being aware of the ten common errors outlined, you can enhance your application’s quality and increase your chances of success. Ensuring compliance, maintaining transparency, and preparing adequately will not only streamline your journey but also fortify your position in a competitive market. Staying informed and proactive is key to avoiding pitfalls and achieving your regulatory goals.

FAQ

Q: What are common reasons for FCA authorisation errors?

A: Some common reasons for FCA authorisation errors include incomplete applications, lack of supporting documentation, failure to meet the necessary compliance standards, and providing inconsistent information. It’s important for businesses to thoroughly review their submissions for accuracy and completeness to avoid such issues.

Q: How can firms ensure their FCA application is complete?

A: Firms can ensure their FCA application is complete by carefully reviewing the FCA’s guidelines and requirements, compiling all necessary documentation, and utilizing checklists to verify that all components of the application are included. Additionally, seeking legal or consultancy advice can help highlight any potential gaps.

Q: What should be done if an FCA application is rejected?

A: If an FCA application is rejected, firms should carefully read the rejection letter to understand the reasons behind it. They can then address the specific deficiencies outlined, gather any additional required information, and reapply. It may also be beneficial to engage with the FCA through discussions to clarify issues.

Q: Are there specific forms or templates to follow for FCA submissions?

A: Yes, the FCA provides specific forms and templates that applicants must follow when submitting their applications. It’s imperative to use the current versions available on the FCA’s official website and ensure accuracy in filling out all required fields to avoid potential errors.

Q: How can a firm stay updated on FCA regulation changes that may affect their authorisation?

A: Firms can stay updated on FCA regulation changes by subscribing to FCA newsletters, regularly visiting the FCA’s website, attending industry seminars and webinars, and participating in relevant professional associations. Keeping communications open with industry peers can also provide insights into potential regulatory changes.

Q: What role do compliance consultants play in the FCA authorisation process?

A: Compliance consultants can provide valuable expertise in navigating the FCA authorisation process. They can help firms prepare their applications, ensure all documentation is in order, and guide them through regulatory requirements. Their insights can significantly reduce the chances of application errors and streamline the authorisation process.

Q: How long does the FCA authorisation process typically take, and what factors can influence this timeline?

A: The FCA authorisation process can take anywhere from a few weeks to several months, depending on factors such as the complexity of the application, the level of detail provided, and whether there are any requests for additional information from the FCA. A well-prepared application is likely to expedite the process compared to one that is missing key elements.

To Contact Us

Tel; UK 0800 689 0190,

International +44 207 097 1434

Email: info@complianceconsultant.org

If you’d like us to contact you to discuss your specific situation and how we may be able to help,

please provide your contact details using the form below and a member of our team will get in touch.

You may also be interested in;

UK FCA Authorisations: Complete Guide

FCA Authorisation Process Explained

How Long Does FCA Authorisation Take?

FCA Compliance Monitoring Explained