It’s imperative for you to navigate the complexities of FCA authorisation effectively if you want to operate in the financial services sector. This process can be daunting, but with the right strategies in place, you can streamline your application and increase your chances of success. In this post, we will explore 10 practical tips that will help you master the FCA authorisation process, ensuring that you are well-prepared and can meet all regulatory requirements with confidence.

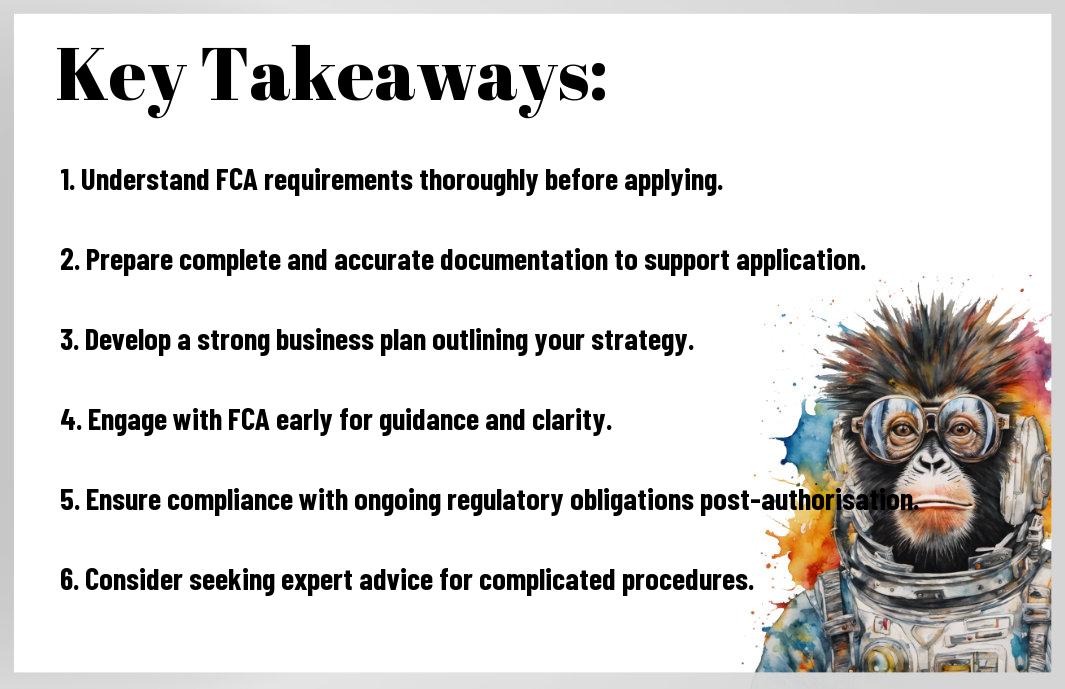

Key Takeaways:

- Understanding the FCA’s regulatory framework is vital for a successful authorisation process; familiarize yourself with key requirements and guidelines.

- Prepare comprehensive documentation that clearly outlines your business model, governance, and risk management strategies to enhance your application.

- Engage with the FCA early in the process and seek feedback to address potential issues proactively, ensuring a smoother application experience.

Understand Regulatory Requirements

Before you begin on the journey toward FCA authorisation, it’s necessary to understand the regulatory landscape governing your sector. Familiarizing yourself with these requirements will ensure your application is compliant and thorough, enabling you to navigate the process with confidence. This involves understanding the principles, standards, and obligations set forth by the FCA and being prepared to demonstrate your understanding in your submissions.

Familiarize with FCA Rules

Rules set forth by the FCA are the framework that governs how financial firms must operate. These rules cover everything from conduct and reporting requirements to risk management standards. You should familiarize yourself with these guidelines, ensuring your business model aligns with FCA expectations. This will not only assist in your application but also establish a strong compliance culture within your organization.

Identify Appropriate Permissions

Rules dictate that you must determine the specific permissions you need based on your firm’s activities. Understanding the scope of your business can help you identify which FCA permissions are relevant. This may include investment management, advising, or operating a payment service—each requiring distinct compliance measures. You’ll need to consider the full range of services your firm intends to offer and select permissions accordingly to ensure you’re operating within the law.

Any oversight in identifying appropriate permissions can lead to delays or rejections in your application process. It is vital to accurately assess your business operations against the FCA’s guidelines to avoid potential pitfalls. Consider seeking legal counsel or consulting with professionals who specialize in FCA applications to provide clarity on which permissions are necessary for your specific services. This proactive step will streamline your application process, aligning your firm with the requirements set by the regulator.

Prepare Comprehensive Business Plan

Some key elements of a business plan are necessary for successful FCA authorisation. It should articulate your mission, vision, and strategic goals. The FCA expects your plan to demonstrate how your business will operate, including compliance with regulatory requirements. Your business plan should also outline the key services or products you will offer, the competitive landscape, and how you intend to attract and retain customers. A well-thought-out plan is your foundation for navigating the application process.

Outline Business Model

Plan your business model meticulously, illustrating how your company will generate revenue and deliver value to clients. This should include details about your target market, pricing strategies, and distribution channels. Be clear about your unique selling propositions, which will differentiate your offerings in a competitive market. A well-structured business model not only serves to attract investors but also facilitates your FCA application’s approval.

Include Financial Projections

To secure FCA authorisation, it’s important to provide detailed financial projections for your business. This includes forecasts for revenue, expenses, and profitability over at least the next three years. You should also outline your cash flow expectations, highlighting any financial risks and how you plan to mitigate them. This information will help demonstrate your business’s viability and your understanding of the financial obligations required in the financial services sector.

Plus, these financial projections should be realistic and based on thorough market research. Providing assumptions behind your numbers is imperative; this shows the FCA that you have a grasp on market dynamics and customer behavior. It’s advisable to model different scenarios, including best-case and worst-case projections, to showcase your preparedness for various challenges. Clear and thorough financial documentation can significantly strengthen your application, reflecting your diligence and commitment to sustained compliance and transparency.

Establish effective governance

Once again, effective governance is vital for your FCA authorisation process. A robust governance framework helps ensure compliance with regulations while promoting accountability and transparency within your organisation. Establishing clear lines of responsibility and understanding the roles of each individual, as well as decision-making protocols, will position you for success. This not only aids in regulatory adherence but also enhances your overall operational efficiency.

Appoint competent individuals

With the right individuals in key positions, your governance framework will thrive. Consider candidates who possess relevant experience, skills, and an understanding of the FCA’s expectations. This way, you can ensure that your board and senior management are well-equipped to navigate the complexities of regulatory requirements.

Maintain clear structures

To establish a solid foundation for your governance framework, it is imperative to maintain clear structures within your organisation. Well-defined roles and responsibilities facilitate efficient decision-making and prevent overlap in duties. Clarity in reporting lines helps everyone understand who to approach for specific concerns, ensuring that issues are addressed promptly and effectively. Additionally, structured committees can enhance oversight and governance, allowing for better risk management and regulatory compliance.

Structures within your organisation should be designed to promote effective communication and collaboration. You should ensure that your governance framework establishes distinct lines of authority and reporting, allowing matters to flow smoothly throughout the organisation. Regular reviews and updates of these structures will keep your governance relevant and effective, enabling you to adapt to changes in regulations or market conditions. Prioritising clear structures ultimately leads to a more agile and responsive organisation.

Ensure robust compliance framework

Keep in mind that establishing a robust compliance framework is vital to meeting FCA authorisation requirements. This framework should include risk assessments, clear lines of accountability, and commitment to ongoing training for your staff. Strengthening your compliance framework not only demonstrates your dedication to regulatory obligations but also enhances your organization’s operational practices, ultimately ensuring a smoother path through the FCA’s authorisation process.

Implement policies and procedures

For your compliance framework to be effective, you must implement comprehensive policies and procedures that are regularly updated. These documents should clearly define your firm’s compliance objectives, risk management strategies, and staff responsibilities. Ensuring that everyone is on the same page enhances compliance culture within your organization while aligning your operations with regulatory standards.

Regularly review compliance

One of the key aspects of maintaining compliance is to regularly review your practices and policies. This ongoing evaluation allows you to identify any deficiencies or areas of improvement and adapt to changing regulations or business circumstances.

A systematic approach to reviewing your compliance process should involve conducting audits, soliciting feedback from staff, and staying informed about regulatory updates. Engaging external consultants can offer valuable insights as well. By consistently checking and refining your compliance measures, you build a culture of accountability and transparency, which are imperative for fostering trust with regulators and your clients alike.

Provide Adequate Financial Resources

For a successful FCA authorisation, it is imperative to demonstrate that your business has sufficient financial resources. This includes not only initial capital but also ongoing funds to support your operations, comply with regulatory requirements, and absorb potential losses. By ensuring your financial foundation is robust, you will enhance your chances of obtaining and maintaining FCA authorisation.

Assess Capital Requirements

Provide a thorough assessment of your capital requirements to satisfy the FCA’s guidelines. This involves understanding the minimum capital thresholds applicable to your business type and determining additional capital needs based on your operational risks and business model. A proactive approach to capital planning demonstrates your commitment to financial stability.

Maintain Liquidity Standards

The FCA mandates that you adhere to specific liquidity standards to safeguard your firm’s operational integrity. This means ensuring that you can meet your short-term obligations as they arise, which is vital in maintaining trust with clients and regulators alike.

You can achieve liquidity standards by regularly monitoring your cash flow and maintaining readily accessible funds. This includes diversifying your assets and securing lines of credit to ensure you can respond swiftly to financial demands. Establish a system to evaluate liquidity ratios, as this will help you identify any potential shortfalls early and take corrective actions promptly. Consistent adherence to these standards not only satisfies FCA requirements but also enhances your company’s resilience against market fluctuations.

Develop a Clear Risk Strategy

Now that you understand the importance of risk management, developing a clear risk strategy is crucial for your FCA authorisation. A well-defined strategy will guide your business in identifying, assessing, and controlling risks, ensuring compliance with FCA requirements and enhancing operational resilience. This proactive approach will not only demonstrate your commitment to strong governance but also help you build trust with stakeholders and clients.

Identify Potential Risks

Strategy begins with recognizing the various risks that your business may face. Consider conducting a thorough risk assessment that analyses both internal and external factors affecting your operations. This includes market, credit, operational, and compliance risks. Being aware of these potential pitfalls enables you to prepare for challenges that could jeopardize your FCA authorisation.

Mitigate through Controls

Some effective ways to mitigate risks involve implementing a robust system of internal controls. By establishing clear procedures, conducting regular audits, and ensuring comprehensive staff training, you can create a strong framework that reduces the likelihood of risk materialization. This proactive stance supports your overall risk strategy and enhances your FCA compliance.

With effective internal controls, you can manage risks systematically. Controls should be tailored to the specific needs of your business and regularly reviewed to adapt to changing market conditions. Consider utilizing risk management frameworks, such as the COSO or ISO 31000, to help structure your approach. Additionally, encourage a culture of risk awareness among your team, empowering them to identify and report issues promptly. This holistic strategy ensures that you effectively mitigate risks while working towards your FCA authorisation goals.

Engage with FCA early

Not waiting until the last minute to engage with the FCA can significantly enhance your application process. By initiating contact early, you can better understand the regulatory landscape and address any potential challenges before they arise. This proactive approach allows you to set realistic timelines and align your business strategy with the FCA’s expectations, ultimately leading to a smoother authorisation experience.

Seek advice proactively

Seek guidance from regulatory experts or consultants who specialize in FCA authorisation. Engaging with professionals who have a deep understanding of the FCA’s requirements can provide you with valuable insights. They can help you navigate complex regulations, identify necessary documentation, and streamline your application, ensuring you’re well-prepared to meet the FCA’s expectations.

Clarify submission process

Engage with the FCA to clarify the submission process from the outset. Understanding each step can help you compile the necessary documents accurately and on time. This will assist you in meeting the FCA’s standards and confirming that nothing is overlooked. Establishing a clear line of communication with your case officer will further enhance your comprehension of the process involved.

Clarify the specifics of the submission process by asking detailed questions about what the FCA expects at each stage. Familiarize yourself with the types of documents required, potential timelines for review, and how to format your application correctly. The more informed you are about these elements, the better equipped you will be to present your case effectively and avoid unnecessary delays. Engaging with the FCA for clarification can also help you identify areas where additional information may be needed, enabling you to strengthen your application before submission.

Gather Quality Documentation

Your application for FCA authorisation hinges significantly on the quality of your documentation. This means gathering all relevant documents meticulously and ensuring they align with the specific requirements outlined by the FCA. Quality documentation not only streamlines the application process but also increases your chances of approval by demonstrating a strong foundation for your business operations.

Compile Necessary Evidence

You’ll need to gather comprehensive evidence that supports your application, including policies, procedures, and financial forecasts. This evidence should reflect the operational reality of your business and showcase your understanding of regulatory expectations. The clearer and more detailed your evidence is, the stronger your application will appear to the FCA.

Ensure Accuracy and Completeness

Compile all your documents with great attention to detail. You should review each piece for accuracy, ensuring that all figures, names, and descriptions are correct. In the FCA’s eyes, incomplete or incorrect documentation might raise red flags during the assessment process.

With meticulous attention to detail, you can avoid unnecessary delays or complications in your application. Ensure that every document is not only accurate but also complete; missing information can lead to a rejection or further inquiries from the FCA. Double-check your submissions for any discrepancies and keep a consistent format throughout your documentation, making it easier for reviewers to digest the information presented.

Prepare for Assessment Interviews

Many organizations underestimate the importance of preparing for assessment interviews during the FCA authorisation process. These interviews are a vital opportunity for regulators to gauge your suitability and understanding of compliance. It is necessary to approach them with careful planning, solid knowledge of your business operations, and a clear articulation of your objectives. A well-prepared team equipped with relevant information can significantly enhance your chances of a successful outcome in this stage of the authorisation process.

Train Key Personnel

You must ensure that key personnel are well-trained and equipped to handle the assessment interviews effectively. This involves not only understanding regulations and compliance standards but also being prepared to articulate your business model and risk management strategies clearly. Involving your team in the preparation process will build confidence and ensure that everyone is on the same page regarding expectations and responses to potential questions.

Practice Prospective Questions

You’ll want to simulate the assessment interview by practicing prospective questions that may arise during the actual interview. This exercise helps to familiarize yourself and your team with the kinds of inquiries you may face from FCA representatives, allowing you to formulate concise and relevant responses. The more you engage in these practice sessions, the more comfortable you’ll become when discussing your processes and compliance measures.

Train your team to anticipate various scenarios and possible questions, focusing on areas like business strategy, governance structures, and risk management. Role-playing these situations can provide valuable insights into how well your personnel communicate your objectives and respond under pressure. The confidence gained from repeated practice will help to alleviate anxiety during the real interview, allowing you to present your information more clearly and persuasively.

Maintain Ongoing Communication

Unlike other regulatory bodies, the FCA emphasizes the importance of continuous engagement. Keeping an open line of communication is vital to ensuring that your firm remains compliant and informed about any changes that may affect your operations. A proactive approach can help you address potential issues before they escalate and foster a positive relationship with the FCA.

Keep FCA Informed

Keep the FCA updated on any significant changes within your organization, such as alterations in management, operational procedures, or financial status. This transparency not only helps build trust but also allows the FCA to offer guidance tailored to your current circumstances, ensuring that you stay aligned with regulatory requirements.

Address Inquiries Promptly

There’s no room for delays when it comes to responding to FCA inquiries. Timely answers demonstrate your commitment to compliance and your willingness to cooperate fully. Quick responses can also mitigate potential misunderstandings and foster a collaborative atmosphere.

For instance, if the FCA asks for additional documentation or clarification regarding your operations, address their inquiries without delay. This not only resolves issues efficiently but also positions your firm as attentive and responsible, potentially leading to more favorable outcomes in the long run. A prompt response also allows you to clarify any misunderstandings and show your commitment to adhering to regulatory expectations.

Summing up

From above, you can see that mastering FCA authorisation requires careful preparation and attention to detail. By following these 10 tips, you can streamline the application process and enhance your chances of success. Focus on understanding the regulatory framework, maintaining clear communication, and ensuring compliance with all guidelines. Each step you take brings you closer to achieving your goal, providing a strong foundation for your financial services business. With the right approach, you will confidently navigate the complexities of FCA authorisation.

FAQ

Q: What is FCA authorisation and why is it important?

A: FCA authorisation is the process through which financial services firms in the UK obtain permission from the Financial Conduct Authority (FCA) to operate legally. It is important because it ensures that firms adhere to regulatory standards, maintain consumer protection, and promote fair competition in the financial market.

Q: What are the initial steps to take when applying for FCA authorisation?

A: The initial steps include determining the type of authorisation needed, preparing the necessary documentation, and ensuring compliance with the FCA’s rules and principles. It’s also advisable to consult with experts in compliance and regulation to guide you through the process.

Q: How can I effectively gather the necessary documentation for my application?

A: To gather the necessary documentation, facilitate a comprehensive checklist that includes details on business structure, financial forecasts, compliance arrangements, and risk management strategies. Collaborating with your team and possibly hiring a compliance consultant can streamline this process.

Q: What role does a business plan play in FCA authorisation?

A: A business plan is vital for FCA authorisation as it outlines your firm’s objectives, strategies, and operational structure. It should reflect how you plan to meet regulatory standards, manage risks, and support consumer interests. A well-crafted business plan enhances your application’s credibility.

Q: How important is it to have appropriate compliance systems in place before applying?

A: Having appropriate compliance systems is important for a successful application. These systems should include policies, procedures, and controls that ensure adherence to regulatory requirements. The FCA will assess how well you plan to manage compliance risks, making this a key aspect of your application.

Q: What are some common pitfalls to avoid during the FCA authorisation process?

A: Common pitfalls include insufficient documentation, lack of a clear business plan, inadequate financial resources, and overlooking operational risks. It’s also important to stay updated with FCA guidelines as failing to meet recent changes can lead to setbacks in your application.

Q: What can I do to increase my chances of a successful FCA authorisation outcome?

A: To increase your chances of success, ensure that your application is thorough and well-prepared, engage with the FCA early in the process, maintain clear channels of communication, and seek feedback on your documentation. Demonstrating a strong understanding of regulatory requirements will also strengthen your application.

To Contact Us

Tel; UK 0800 689 0190,

International +44 207 097 1434

Email: info@complianceconsultant.org

If you’d like us to contact you to discuss your specific situation and how we may be able to help,

please provide your contact details using the form below and a member of our team will get in touch.

You may also be interested in;

UK FCA Authorisations: Complete Guide

FCA Authorisation Process Explained

How Long Does FCA Authorisation Take?

FCA Compliance Monitoring Explained